The market continues to be tough in Italy. According to Italian beauty trade association Unipro, total sales were up by a mere 0.6 percent in value in the first six months of 2012, while the perfumery channel saw a decline of 4.5 percent. Overall the beauty market has been flat, and few predict any improvement for the upcoming holiday season.

The perfumery channel has been hit particularly hard. Brands sold in the channel have been negatively impacted by problems at the Limoni chain, which is Italy’s largest beauty retailer with 430 stores and a 15 percent market share. The retailer was on the verge of bankruptcy this year and weighed down by $474 million [at current exchange rate] in debt leading to much uncertainty about its future. In August, Limoni received a bailout, saw its restructuring plan agreed upon by banks and its debt reduced to $150 million. The company is now embarking on a new strategy, which involves store closures, greater segmentation of its store network and a review of its product assortment. “We will close 40 perfumeries—the smallest less profitable ones—and we are already reorganizing the store network into three clusters. We need to adapt assortment and service to the identity of our stores, which can vary a lot,” Limoni Chief Executive Officer Richard Simonin told BW Confidential.

In addition to Limoni’s woes and a decline in consumer spending, the perfumery channel has also suffered from a transfer of sales to other retail channels. “Competition is not only coming from pharmacies and para-pharmacies, but also from mono-brand stores whose identities are radically different,” explains beauty director NPD Group Italy Sylvie Cagnoni.

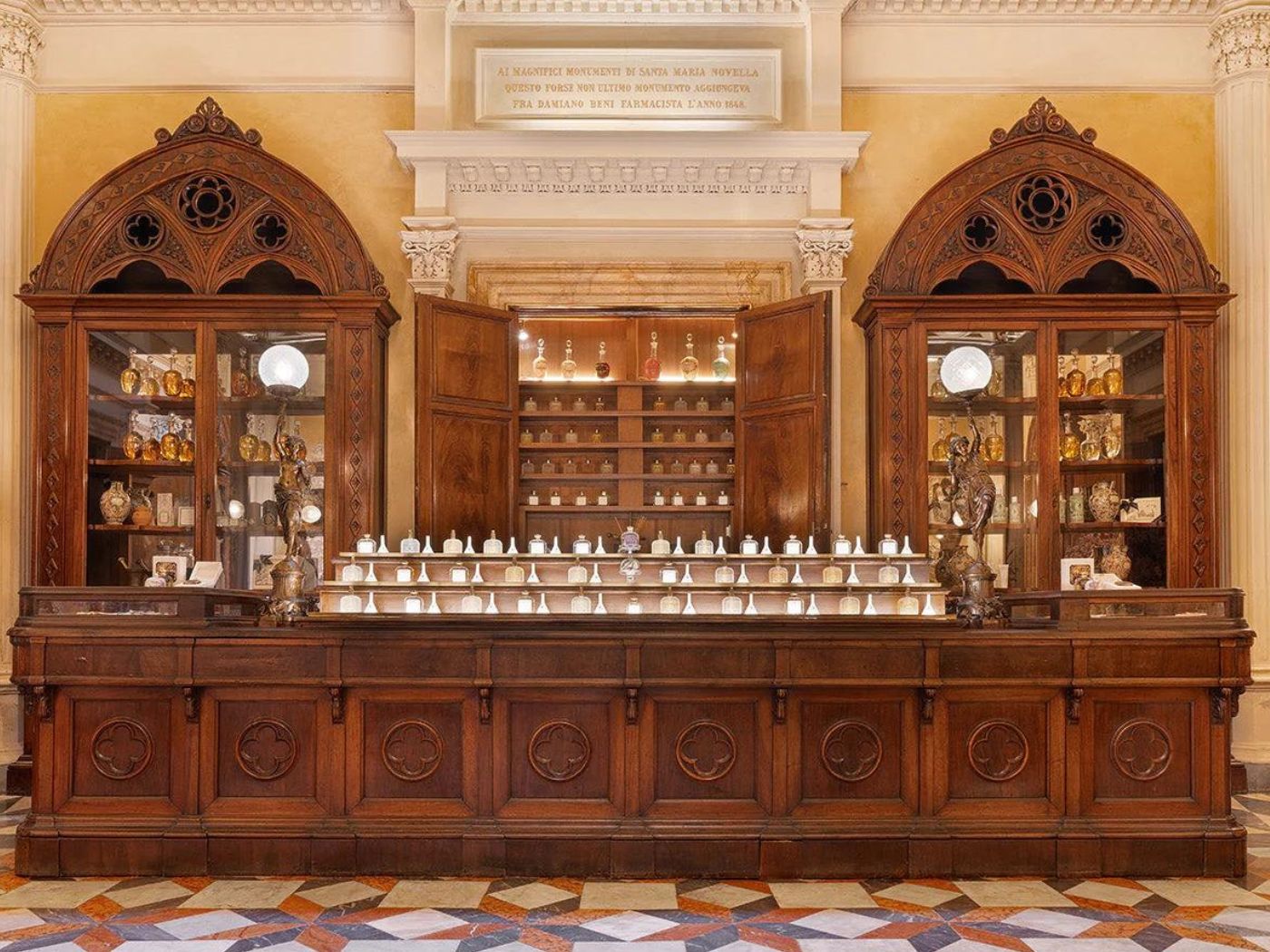

Mono-brand stores are surfing on the “green” wave. Companies such as Bottega Verde, Yves Rocher and especially L’Erbolario, which is now adding make-up to its portfolio, continue to expand and have become serious competitors to perfumeries.

To read BW Confidential’s full report on the beauty market in Italy go to: www.bwconfidential.com.