From beauty products enriched with egg yolk extract to carbonated water masks, Korea is on the pulse of breakthrough formulations and ingredients. Add to that an array of whimsical product packaging, and K-Beauty has captivated the world with its originality and marketing appeal, resulting in engaged consumers and profitability.

“One of the greatest assets of Korean brands is their hyper-speed innovation, which remains the primary driver behind the heat of the beauty trend,” explained Sarah Lee, Co-CEO & Co-Founder, Glow Recipe. “New products with fresh concepts are constantly and consistently being brought to market, creating buzz and excitement.”

This constant stream of newness has introduced a new challenge for American retailers in regard to education, as many of these products are unfamiliar to consumers and part of an elaborate and customized Korean skin care regimen.

“With so much innovation coming out of Korea, it’s important for Sephora to help clients understand what each product will do for her, to demystify the K-Beauty routine and explain how certain products will aid [her] routine,” noted Priya Venkatesh, VP/DMM, Skincare/Hair & Merchant Product Innovation, Sephora. “Our brand partners bring us an incredible amount of skin care innovation out of Korea and our role as merchants is to help curate the right products for our market and client.”

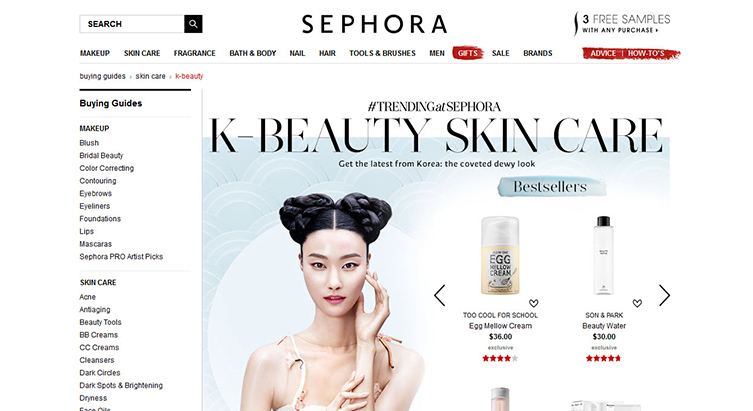

Sephora, which was one of the first retailers in America to offer K-Beauty in-stores, has devoted prominent store and digital space to the movement. The retailer offers an assortment that ranges from small, indie brands to classic Korean brands, such as AmorePacific, which disrupted the foundation category in 2008 with the introduction of its cushion compact technology.

“The AmorePacific team carried out more than 3,600 tests with over 200 types of sponges to perfect the technology,” said Bradley Horowitz, President & CEO, AmorePacific U.S. “As of 2016, we have sold 100 million-plus cushion units worldwide.”

The company, which has a portfolio of several successful K-Beauty brands, including LANEIGE and Sulwhasoo, has attracted a strong global customer base and puts 3 percent of its annual revenue back into R&D to stay at the forefront of innovation.

“AmorePacific has a 40 percent share of the Korean Beauty marketplace, forever making it the leading disruptor in the Korean beauty sphere and the leader of the K-wave,” noted Bradley. “Our R&D Center was the first cosmetic research center to be established in Korea (1954), and it is currently the largest R&D among cosmetic companies in Korea.”

To gain market share, smaller K-Beauty brands have become conscious of the need to adjust their packaging and communication to match US consumer needs.

“We’ve all heard about the infamous 10-step K-beauty routine, but we’re beginning to see more hybrid products, such as in-shower treatments that exfoliate, hydrate and tone; multitasking priming moisturizers, and overnight peeling masks, all of which appeal to busy Korean and U.S. consumers,” said Sarah.

Given the fast-paced innovation K-Beauty is known for, it’s key to stay ahead of the trends.

“The Sephora merchant team regularly travels to Korea and other Asian countries to discover what is cool, innovative and cutting-edge in order to bring the best selection to our clients,” said Priya. “We also spend time reading blogs and watching YouTube videos to anticipate trends and what our consumers will want in the future.”

And that’s just the beginning.

To hear about more upcoming K-Beauty trends, register to attend CEW’s Beauty Insider Series K-BOOM! event, which will take place on Monday, February 6 at The Union League Club in Manhattan. Bradley, Sarah and Priya will all be on hand to share deeper insights on the K-Beauty phenomenon, including product innovations and selling strategies that are engaging the evolving beauty consumer. Plus, you’ll learn about the key ingredients to their successes and how to apply it to your business or brand to stay a step ahead of the competition. Click here to register.